Xero Invoicing Review 2024 (2024)

Our Research

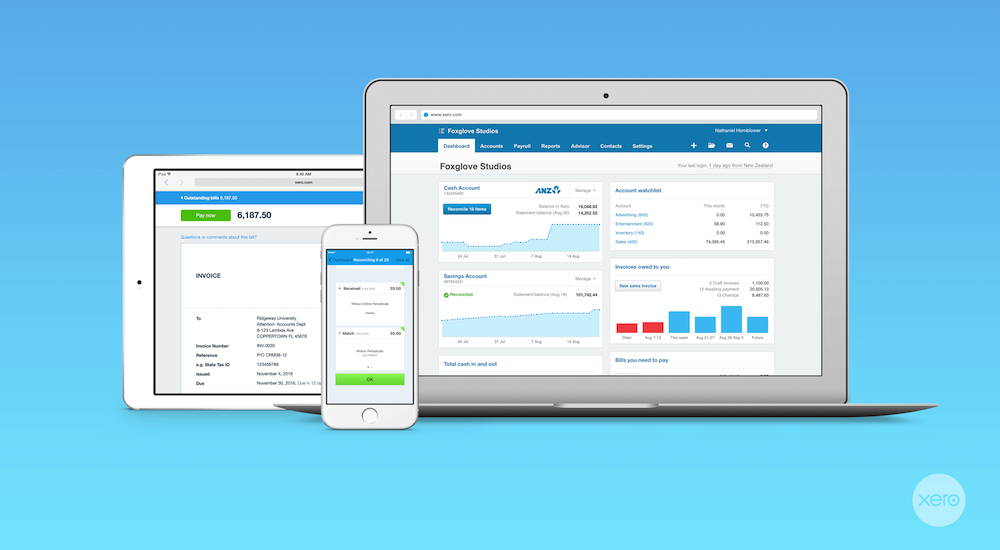

Business owners, freelancers and entrepreneurs often spend a large chunk of time on administration and accounting. Suited for small- and medium-sized businesses (SMBs), Xero is an affordable cloud-based accounting software system that streamlines these processes with plans starting at $13 per month.

Xero Pros & Cons

Pros

- Competitively-priced plans

- Unlimited users and clients

- Free 30-day trial

- Extensive online tutorials and support to learn the more complex systems

Cons

- Quotes and invoices are limited to 20 per month on the lowest priced plan

- Involves a learning curve

- Multiple currencies only available for highest subscription tier

Xero at a Glance 8.8 Editor Score

Integrations

8.5

Products

9.1

Promotions

8.5

Features

8.0

Customer Service

9.5

8.8 Editor Score

How do I know I can trust this Xero Review?

TopRatedTen.com authors, contributors, and editors are serious about research. We combine our own experience with the services we recommend, with reviews that come from verified users–just like you! Together, with reviews from industry experts, we find the Top 10 best products and services to make sure you can choose with confidence and ease.

Xero at a Glance

Xero includes extensive features that make it suitable to handle complex accounting processes for small- and medium-sized businesses as well as larger ones. The software makes it easy to pay bills, claim expenses, accept payments, track projects, manage contracts, store files and more.

Here is how the monthly fees for Xero break down:

- Early: $13 per month

- Growing: $37 per month

- Established: $70 per month

The Early subscription is tailored for solopreneurs and business owners who are just getting started. You’re able to send 20 quotes and invoices per month, enter five bills, reconcile bank transactions, capture bills and receipts with Hubdoc and view a short-term cash flow and business snapshot.

The Growing plan is best suited for growing businesses, grants the same capabilities in addition to the ability to send unlimited quotes and invoices, enter unlimited bills, and reconcile transactions in bulk.

The Established price tier is the company’s plan for businesses that are already up and running, particularly businesses that service international audiences or markets. It provides the ability to use multiple currencies, track projects, claim expenses and view in-depth analytics, in addition to the features mentioned above.

All three plans come with an optional add-on for payroll with Gusto for $40 per month plus $6 per month per person. Gusto is a platform that automates payroll filing for all 50 states in addition to automating payroll taxes, deductions and filings and providing employees with the platform to view pay stubs and W-2s online.

Xero’s invoicing capabilities allow you to create and customize an invoice for clients and then accept credit card, debit card or bank transfer payments within the invoice itself. Account holders are able to customize online invoices to add a logo, accept payments instantly through the invoice, set automatic reminders for clients to pay and invoice directly from the Xero app. Xero processes payment through a payment gateway like Stripe, GoCardless and others. Keep in mind that these services charge a fee to process payments (usually around 2.9% plus 25 cents per transaction, though this varies by the payment processor).

Features and Add-ons

Contact Saving

Xero makes it possible to save complete records of your billing customers and suppliers.

In addition to basic fields such as name and email address, Xero also lets users register customers’ financial details, tax information, and billing terms.

Users can also configure default payment due dates for customers so that they do not have to populate that information on every invoice manually.

Xero also allows users to assign individual billing contacts into groups. This is useful where several invoices, assigned to different points of contact, might need to be sent into the same organization at once.

Automated Follow-Ups

Chasing down overdue invoices is a time-consuming chore for both small businesses and large accounts receivable departments. Xero allows users to configure a reminder cadence which will send a series of emails to customers at periodic intervals after their invoice has fallen overdue.

Integrated Inventory Tracking

Typically, invoicing systems either integrate with ERP tools used for stockeeping, or don’t have a stock-keeping functionality at all. Xero opted instead for the middle ground, allowing users to choose to track specific items for inventory purposes. When users tick the “I track this item” box, a unit count will be deducted from the initial account and users will be prevented from adding the item to invoices if its quantity falls to zero.

Multiple Document Types

Xero allows users to create the full range of commonly required documents for billing and sales purposes. These include:

Sales invoices

Credit notes

Quotes

Bills

Repeating bills

Purchase orders

Xero also has the ability to create repeating sales invoices. For businesses that have ongoing retainer-based contracts with clients, this means that billing can be set up automatically. Users simply need to configure the contract initiation and end dates and select whether they want to have to manually approve the invoices before they send.

Expense Management

Xero also supports managing expenses. Users are able to both manage their own expenses or set up administrative permissions to approve or deny subordinates’ or colleagues’ expense requests. As part of this feature, Xero includes receipt analysis which uses Optical Character Recognition (OCR) and other technology to automatically parse submitted expenses and pull out details including supplier names and amounts.

App Integrations

Users that want to do more with Xero are able to integrate with any of the apps available through its App Marketplace.

Some of the invoicing tools which can be connected to provide further functionality include:

simPRO for end-to-end business management

Service8 for field service visit coordination and billing

WorkflowMax for quotes, timesheets, and financial project management

PracticeIgnition for sending clients smart proposals that they can read, sign, and approve in one place

There are also integrations for project management tools, including Xero Projects, and Harvest, a popular time tracking and reporting app.

Accounting

In addition to handling invoices, users can also create accounting reports from within Xero.

The range of reports that can be produced includes:

Fixed asset reports

Aged payables reports

Supplier invoice reports

Users can also directly attach their accounts to the platform to receive account-based reporting and create a more complex Chart of Accounts for auditing and book-keeping purposes.

Payment Options

Xero supports online payments—so customers can choose to send a ‘pay now online’ option which each invoice. The range of options that Xero supports for this purpose includes:

Apple Pay

Credit Card

Debit Card

Users can also pay via transfer over the ACH system. These can be initiated online.

The company uses Stripe and GoCardless for online and ACH debit payments respectively. Although taking payments through these services entails losing a small amount of the invoice value due to commission, businesses often find that they can get paid quicker once they provide clients with an option to pay online.

Pricing & Plans

Xero is available at 3 tiers:

Early : $9/month

Growing : $30/month

Established : $60/month

Early : $9/month

Growing : $30/month

Established : $60/month

Usability

In terms of usability, Xero ranks as a very easy invoicing tool to come to grips with. Its user interface is clean and easy to navigate around. Users have a notification display located at the top right corner of the screen. This presents notifications regarding any invoicing related activity such as newly received inbound files, expenses that need to be approved, and other such actions.

Xero Alternatives and How They Compare

| Xero | FreshBooks | QuickBooks | |

|---|---|---|---|

| Starting Price (Monthly) | $13 | $17 | $30 |

| Free Trial | 30 days | 30 days | 30 days |

| Free Version | No | No | No |

| Maximum Users | Unlimited | 1 - $10 per month for each additional user | 1 |

| Number of Clients | Unlimited | 5 | Unlimited |

| Quote and Invoices | 20 per month | Unlimited | ✓ - With Simple Start plan ($25/month) |

| Track Miles | ✓ | ||

| Customizable Features | Good | Good | Excellent |

| Customer Support | 24/7 online support through live chat, knowledge base, help center, email support, blog and guides | Phone and email support, live chat, knowledge base and help center | Live chat, video tutorials, phone and email support |

Xero, FreshBooks and QuickBooks all offer 30-day free trials and extensive features for online support, including a live chat, email support and a knowledge base. All three of these offer the ability to scale their accounting for larger businesses and both Xero and QuickBooks offer specific training for accountants. These companies offer Gusto integration for the same price—$40 per month and $6 per month per person. On the other hand, FreshBooks may be a better fit for freelancers and solopreneurs, as the capabilities are easier to navigate.

QuickBooks caps the number of users who can use the account. It allows three users for its Essentials plan ($55 per month) and 25 users for its top plan, the Advanced ($200 per month). Xero, on the other hand, offers unlimited users for all plans. This can be helpful if your company is growing fast, or you simply want the reassurance that there’s no limit to how many people can be part of the team.

Xero has the most affordable lowest tier, at $13 per month. FreshBooks charges $17 per month and QuickBooks charges $30 per month). However, the best option and price point will depend on the specific capabilities and features you are looking for.

Is Xero Right for You or Your Business?

Xero is a great option for large teams and small- to medium-sized businesses that need high-level accounting systems. It’s also a good fit if you want to integrate Gusto Payroll to your accounting platform. However, for freelancers, consultants and solopreneurs mainly looking to send invoices, receive payments and keep track of income, consider some of the free software available including Zoho Invoice, Square Invoices and PayPal Invoicing.

Bottom Line

Xero is a slick invoicing and accounting tool for small business. It has a very impressive integration library and some nice features including the ability to create recurring invoices and send invoices in batches, thereby saving time. This is definitely a tool that we can recommend.